Non-fungible tokens (NFTs) give creators greater control over their work’s display and sale. The company offers artists and creators various services to monetize their creations. Anyone can use these platforms to trade digital assets or to list items for sale since they are open. Hence, these platforms must provide an open forum for NFT transactions if they are to be successful. OpenSea and Rarible are two of the most popular NFT marketplaces today. Both provide an environment where users can buy and sell digital goods, such as artwork, music, and digital collectibles. However, you might find it challenging to choose which one is best for you since each has its distinct features. In this article, we compare the features of these marketplaces so that you can find the one that is right for you. So, let’s get started!

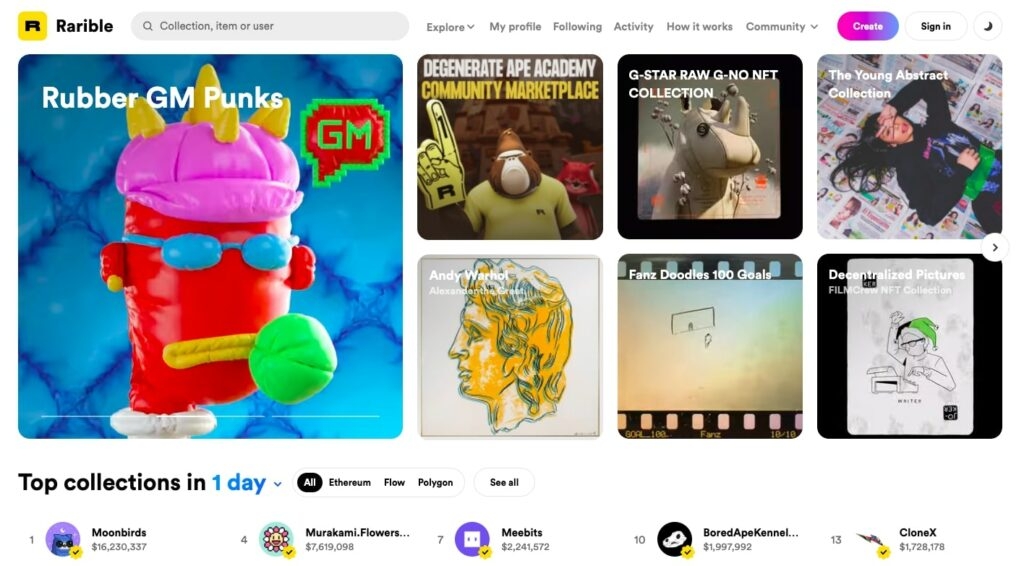

What is Rarible?

Rarible is one of the largest NFT marketplaces that use the Ethereum blockchain. Rareible provides a platform for decentralized autonomous organizations (DAOs). Users create and share digital art by using this platform. In early 2020, Alexei Falin and Alexander Salnikov launched the service in Russia. With easy-to-use minting and trading features, the platform is designed specifically for NFTs. With its dynamic ecosystem, Rareible offers many digital items, including artworks, collectibles, in-game assets, and much more. It creates a market where creativity is sparked and governed, and the platform aims to foster a community of creative people. With Rarible, users can mint digital assets and index them via smart contracts. Afterward, creators can specify how much royalties they want to earn when their products are sold. The platform categories allow buyers to browse various assets to determine if they are interested in anything. Additionally, Rarible also shows the history of the asset, like previous owners and what they paid for NFTs. Even developers can use the data provided by Rarible to create new applications. With thousands of NFT transactions facilitated, Rarible has earned a reputation as a reliable marketplace for NFT transactions.

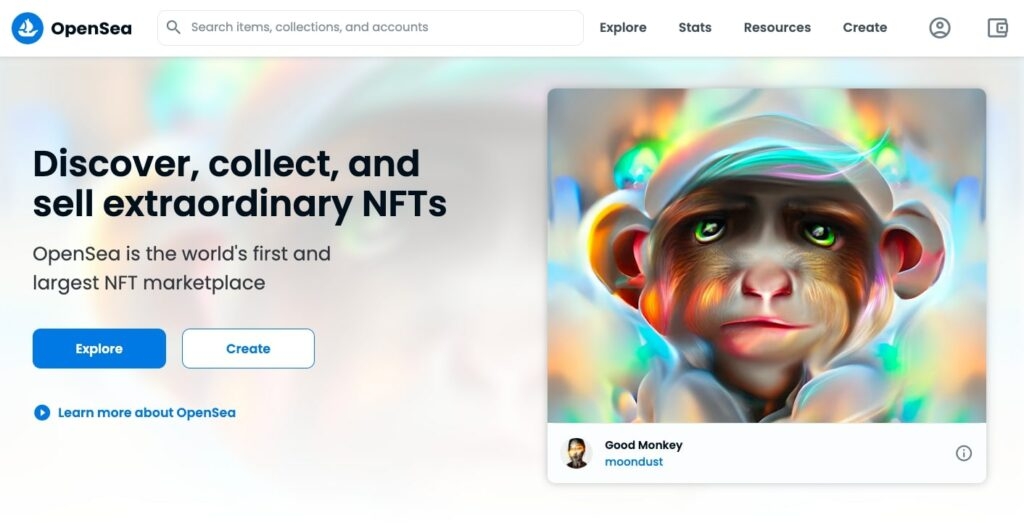

What is Opensea?

OpenSea is a New York City-based DeFi marketplace where users can buy and sell NFTs (non-fungible tokens). Due to a boom in the market, OpenSea sold a record-breaking $3.4 billion asset in August 2021. For Put things into perspective, the company sold $21 million in 2020. A few months after CryptoKitties was released in 2017, Alex Atallah and Devin Finzer joined the early NFT Discord groups. Their passion for the community inspired them to build a new platform for purchasing digital artwork. OpenSea.io was founded in December of that year by the pair. Not only OpenSea was the first marketplace for NFTs and the largest platform for trading crypto-collectibles, with over 300,000. Using the Wyvern Protocol and Ethereum smart contracts, users can easily trade NFTs and other digital collectibles on the decentralized platform. The platform’s category functionality allows buyers to browse and search over 34 million graphics, GIFs, videos, and other digital assets. It allows users to sort crypto art based on type (music, art, video), artist (such as Beeple), collectibles (such as Axie Infinity, CryptoPunks, or Decentraland), or cryptocurrency (such as Ethereum) they wish to purchase. The OpenSea platform was originally built on the Ethereum blockchain but now also runs on Polygon and Klatyn cross-chain as a cross-chain marketplace.

Rarible vs. OpenSea: How do they compare?

Now that you understand how OpenSea and Rarible work, let’s compare their services and features. Now, let’s compare their audiences, supported currencies, wallets, minting, and fees.

Target Audience

With a large trading network and artists, OpenSea is the first NFT marketplace. More than 1.5 million users are active on it. It aims to simplify digital asset purchases and sales. Rarible emphasizes making it easy for its audience to influence business direction despite having a large database and over two million monthly active users. The platform’s creators created a governance token that allows users to decide how to handle upcoming upgrades. Rarible and OpenSea use smart contracts, considered the industry standard for NFT transactions. Because blockchain information is non-fungible, it is easy to trace ownership. Rarible focuses on providing an environment for artists where artists have a voice in how the platform is run, whereas OpenSea focuses on simplifying the purchase and sale of digital goods. People gain control over both their artwork and the market at large by working with the business. In other words, Rareible focuses on the artist, while OpenSea focuses on the artwork.

Supported Currencies

Rarible allows you to buy and sell only using ether (ETH), whereas OpenSea allows you to buy and sell both ETH, DAI, and other Ethereum-based tokens. Among the 150+ cryptocurrencies, you’ll find WHALE, REVV, WKLAY, UNI, and MANA. No platform offers users the option of purchasing NFTs with bitcoin or fiat currency (USD, GBP, AUD, etc.). RARI is its own native currency of Rarible, which is earned from liquidity mining when NFT transactions are made. Trades are not possible with the token. Instead, the governance token provides ownership with a vote over future platform changes. In addition, CoinFund is a backer of the project. Due to washing trading, the project has a few issues. Many Rarible users create multiple accounts to sell and buy tokens to generate RARI tokens from themselves. As a result, a compromise has been made between the token value and the market value.

Supported Wallets

While OpenSea recommends MetaMask, it works with various browser extensions and apps, including Bitski, Coinbase, Arkane Network, Fortmatic, Dapper, Authereum, and Torus. On the other hand, Rarible also integrates with Coinbase Wallet, WalletConnect, MyEtherWallet, Torus, and Fortmatic, as well as Ethereum and Metamask. Considering that both platforms provide integration with many wallets, there is a high probability that your crypto wallet will be supported by either platform.

Minting

Rarible and OpenSea have introduced lazy minting, which makes it easy for artists to sell their NFTs without using a smart contract on the blockchain. As a result of this technique, these platforms have enabled users to mint NFTs without having to pay network fees. In addition to minting NFTs, many blockchain transactions require a network fee to validate the trade. With Ethereum gas fees being pretty high, OpenSea’s and Rarible’s lazy minting features appeal to users since they allow them to avoid these network fees.

NFT Niche

As you learn more about NFTs, you will find that someplace greater importance on specific types of NFTs. Although this is true, most users opt for a more inclusive ecosystem where they can trade and access a wide range of niche NFTs, including digital art, collectibles, in-game assets, fashion, sports NFTs, etc. One of the largest NFT marketplaces is OpenSea, which supports a wide range of digital products and NFTs. Rarible and OpenSea are examples of solutions serving a wide range of NFT niches. NFTs can be found on both platforms in the following categories:

Trading cards In-game assets Memes Virtual assets Digital art Collectibles crypto Domain names

With Rarible, you can search for NFTs in genres such as memes, games, and photography and view top sales and compilations of NFT art.

Platform Fees

In comparison to other NFT marketplaces, OpenSea, and Rarible charge lower transaction fees. OpenSea charges only the buyer a 2.5% fee, whereas Rarible charges both the buyer and seller the same 2.5%. On the other hand, some marketplaces, like SuperRare, charge commissions as high as 15%.

Royalty Fees

Royalties are another important component in the NFT world as they generate extra passive income for creators. In addition to minting NFTs, creators can include a clause that allows them to receive a percentage of secondary market revenue. Hence, whenever NFTs are sold on the secondary market, the original creator receives a predetermined royalty fee. In other words, when NFTs are sold on the secondary market, the original creator gets a set royalty fee. The royalty fee on OpenSea is fixed at 10%. Unlike Rarible, where royalty fees can be set as high as 50% by the original creator, Rarible offers more flexibility.

Security

Security is always a key concern when dealing with digital assets. Security is paramount whenever assets or payments are involved. Since NFTs are traded online, they are vulnerable to hacks, fraud schemes, and data breaches. OpenSea and Rarible have both been involved in scandals involving fraud and fake products. OpenSea has experienced more security breaches than Rarible, despite both platforms experiencing breaches. Due to the open nature of these two markets, it is challenging to prevent the sale of counterfeit products and violations of copyright laws. Both systems have experienced fraud problems; however, OpenSea has experienced many more security problems, the most recent of which involved a smart contract attack that left users vulnerable to NFT thefts. According to a report from Check Point, a cybersecurity firm, it was stated that security issues in an NFT marketplace could allow malicious hackers to steal NFTs and crypto tokens from users.

Which NFT Marketplace Should You Choose?

Ultimately, it all comes down to your personal preferences and what you are willing to sacrifice to access a specific feature or service. For instance, you might be willing to sacrifice the variety of crypto payment options on OpenSea for the ability to purchase NFTs using a credit card on Rarible. Therefore, we have outlined OpenSea and Rarible’s advantages and disadvantages so you can decide which NFT marketplace is most appropriate for you. Advantages and Disadvantages of OpenSea: Advantages and Disadvantages of Rarible:

Conclusion

I hope this article has helped you find the perfect NFT marketplace for your needs. OpenSea and Rarible are two of the most popular NFT marketplaces, offering different features and capabilities. OpenSea offers users a large selection of payment options and projects, while Rarible provides more flexibility in setting up royalties. Ultimately, the choice depends on what you are looking for in a platform and how much risk you are willing to accept. We suggest doing your due diligence, reading up on reviews, and signing up for each platform to decide which one is best for your needs. Whichever platform you choose, ensure it meets all your needs and supports the blockchain you want to use. If you have any further questions or thoughts about this article, feel free to let us know in the comment section below. Thanks for reading!

What is Blockchain? What Makes it so Safe? The Influence of Blockchain on the Finance Industry How To Start Investing In Bitcoin As A Beginner